Factoring is a tailor made package of services designed to improve your cash flow and secure your debts thereby offering you a competitive edge in your markets, both domestic and abroad.

|

What does Factoring offer?

|

- Prepayment of Invoices (up to 80% of invoice value available immediately)

- Professional collection services in India and in more than 30 countries

- Protection against bad debts (up to 100%)

All companies offering credit terms up to 150 days to corporate buyers can make use of factoring services.

|

How does Factoring benefit you?

|

- Improves your cash flow – immediate cash upon presentation of invoices

- We collect on your behalf – you need not spend time on chasing overdue debts

- Avoid languages and time zone issues with your foreign debtors – we use correspondent network to collect debts

- Avoid losses due to bad debts – we credit cover your export buyers

- Fully unsecured – No securities to be provided

- Improve your Balance Sheet ratios – Off Balance Sheet solutions

- Increase your commercial competitiveness

- Focus on what you do best (your own business) and let us help you in what we do best – Finance, Collection and Credit Protection

|

When does factoring apply?

|

- Sales on open account credit terms

- Continuous business relationship with your buyers

- Clear title of receivables

- Assignable receivables

- Clean / Clear performance of the seller

- No counter-trade

|

How much will it cost you?

|

The pricing for factoring services has three major components:

- Fee to set up the factoring package

- Charge applied to the invoice value for the services rendered other than prepayment

- Discounting charge for prepayment of the invoice

Please request a meeting by contacting us at the address mentioned in the Contact Us section.

Alternatively send us an email.

|

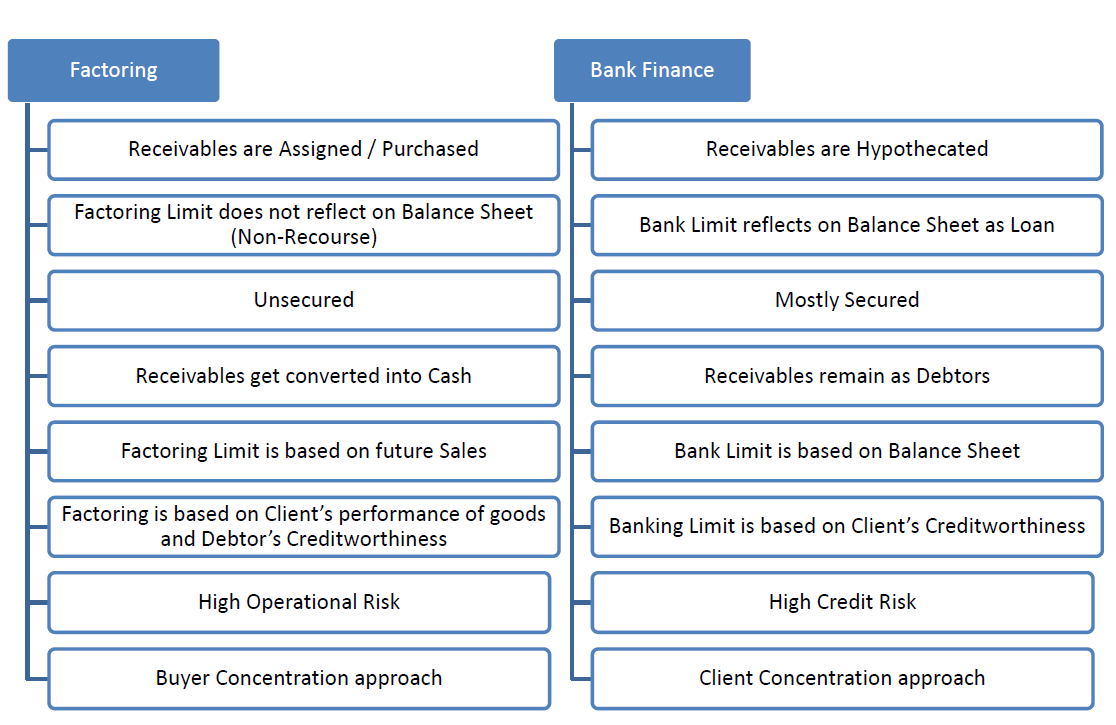

Factoring vs Bank Finance

|